Events Calendar

Contact us if you have an upcoming event you’d like to feature.

FEATURED EVENTS

ECOSYSTEM CALENDAR

Beyond Tomorrow 2025

Secure your ticket for Beyond Tomorrow 2025!

Back for its second year, the Australian Payments Plus summit, Beyond Tomorrow, is where the future of payments and digital identity comes to life.

Join us on 25 March 2025 at ICC Sydney to be part of the conversation and unleash opportunities for the future.

Explore what's next: Gain insights into how Australia’s payment and identity systems are transforming to be more efficient, long-lasting, and future ready.

Uncover unique learning experiences: Across the day, we'll uncover the biggest challenges and potential solutions facing our industry to keep you in the know.

Forge meaningful connections: Connect with peers, experts, and innovators from across the industry.

30min to simpler, technology driven expense management | Webinar by Budgetly

Are you ready to reduce your time spent on expense processing by 70%?

Are you one of the 42% of employees feeling stressed by admin tasks including expense management?

Budgetly helps you manage spending and expenses as they happen.

Outdated expense management processes could be holding your business back—costing you valuable time, resources, and peace of mind. But there's a better way.

Join us for an exclusive webinar with leading finance managers where they share how they revolutionised their spend management by embracing modern technology. This engaging panel discussion will uncover the biggest challenges businesses face with traditional expense management—like limited budget visibility, lost receipts, and inefficient systems—and reveal how innovative solutions are transforming the way companies manage their spending.

Don't miss this opportunity to learn from the experts and gain actionable insights that can help you automate your processes, enhance financial control, and empower your employees.

FinTech Startup/Scale Up Basketball

Teamified, AWS, DoiT, and Thoughtworks are getting the FinTech community together for some hoops and networking on Wed, Nov 27th from 9-11am.

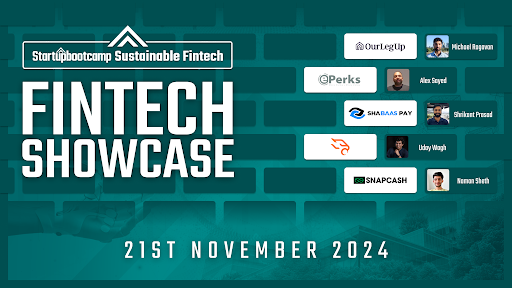

Startupbootcamp's Fintech Showcase - Meet Fintech Startups (Melbourne)

Startupbootcamp is hosting an exclusive event for the Fintech community in Melbourne.

Listen to Fintech Startups Pitch LIVE

Meet our Fintech Alumni - Where they are now?

Hear Updates on the Fintech Global Market

Connect with Fintech Industry Leaders

Agenda

Doors open: 5:00 PM

Startups Begin Pitching: 5:30 PM

Networking and Drinks: 6.30 PM

Doors close: 8.00 PM

Think & Grow Christmas Came Early - Cocktail Party

Think & Grow and Worldpay are hosting an end of year cocktail party at the Boatbuilders Yard in Melbourne on the 20th November. Open invite for industry leaders to round out the year and look forward to 2025.

Date: Wednesday November 20th

Time: 5:30 PM – 9:30 PM

Location: The Boatbuilders Yard, 23 S Wharf Promenade, South Wharf

Securing the future: Fraud prevention, privacy, and innovation in payments - CRC-P Industry Workshop

Securing the future: Fraud prevention, privacy, and innovation in payments

This free workshop offers an in-depth look into securing the future of payments, with industry leaders and experts covering the latest in fraud prevention, privacy protection, and payment technology.

Hosted by RMIT University's Centre for Cyber Security Research and Innovation in collaboration with Novatti and Deakin University, this event brings together academia and industry to provide the latest insights. The workshop features expert talks, a panel discussion, and ends with networking drinks and nibbles.

Arca Credit Summit 2024

The Arca Credit Summit brings together professionals in credit risk, data tech and compliance.

This is the event to hear from the foremost experts about cutting edge developments, regulatory challenges and different industry practices. Attendees will gain new insights, participate in engaging discussions, and network with peers to shape the future of the industry.

Integrating CRM & KYC Data for a Better Client Experience

Find out how to create a brilliant customer experience by integrating your CRM & KYC data - register for our webinar today.

Stripe Tour Sydney

Join us for Stripe Tour, our global roadshow that brings together business leaders in major world cities to discuss the most important trends in payments and financial technology.

Stripe Tour Sydney 2024 brings the best parts of our annual conference, Stripe Sessions, directly to you. Hear from both industry experts and fast-growing Stripe users on how to drive customer value, adapt quickly to economic and technological changes, and ensure longevity in the marketplace.

EOFY Party: Finance Leaders Unwind!

🎉 EOFY Party: Finance Leaders Unwind! 🎉

Join us on June 27th at 5:30 PM for an hour of fun, laughter, and celebration as we wrap up the financial year in style! Hosted by the fabulous people of Cake Equity, FiT, Planet Startup and Tidal.

Whether you're a scale-up finance leader, a firm partner, or a virtual CFO, this is the perfect opportunity to unwind, share experiences, and toast to all the hard work and achievements of the past year. 🥂

📅 Time: 5:30 PM to 6:30 PM

📍 Location: Riverland, Brisbane CBD - Booths 167 Eagle St, Brisbane City QLD

So mark your calendars, bring your best party spirit, and get ready to unwind with the best in the biz.

We are excited to have you join us — see you there! Registration approval is required to attend.✨

Accounting for SMBs in 2025: AI + ESG + Open Banking

Accounting for SMBs in 2025: AI + ESG + Open Banking

Panel discussion & networking event

The Gallery Room, State Library of NSW

5:30pm - 8:30pm, Thursday 27 June, 2024

Brought to you by SISS Data Services in conjunction with Fintech Australia

Hosted by SISS Data Services, and as part of FinTech Australia’s CDR Summit, we’re bringing together thought leaders to discuss the three big issues influencing SMB Accounting as we head into the 2024/25 financial year.

Our distinguished panel will discuss three key issues that will influence the financial reporting and decisions made by Australia’s 2.5m business in the year ahead:

Artificial intelligence

Environmental, Social & Governance (ESG)

The Consumer Data Right (CDR) and Open Banking

Panellists will reflect on their approach to these issues, the interplay between them, and the practical implications for Australian businesses and those who advise them.

The Panel:

Chitra Andy Rajan - ANZ Small & Medium Business Lead, Microsoft

Lars Leber - Vice President, Australia & Rest of World, Intuit QuickBooks

Lochie Burke - Co-founder and CEO, NetNada

Rebecca Mihalic - Director, businessDEPOT

Grant Augustin - Founder & CEO, SISS Data Services

Moderator:

Trent McLaren - Accounting thought leader, Founder of Journey

With opening remarks by:

John Dunkerley - Fintech, ClimateTech & AccountingTech expert

Agenda:

5:30 - 6:30 Arrival drinks

6:30 - 7:15 Panel discussion

7:15 - 8:30 Refreshments & Networking

Invited attendee groups:

Business & financial leaders from small and medium businesses

Leading accountants & bookkeepers & representatives from professional bodies

Fintech, ESG & Accounting technology providers and ecosystem members

RSVP by: 20th June 2024

We look forward to seeing you there!

#ATC24 2-Day International Growth Masterclass

The Australian Tech Competition is running a 2 day Masterclass in Sydney and there's 10 spots open to Founders who didn't apply to join us!

Where: Collider - Tech Central Sydney

When: 18th + 19th June

What: A 2 day Talk/Workshop program guided by Industry experts & networking

Who: An intimate group of 60 Founders looking to scale

As a participant, you will have the opportunity to learn from a range of industry experts, government representatives, past ATC winners and Judges as well as network with fellow semi-finalists and eco-system partners.

The interactive sessions and panellist discussions will equip you with knowledge, contacts and resources to develop and advance your businesses in challenging international markets.

Seating is limited, so secure your tickets now before it sells out.

This 2-day Masterclass Program provides:

Curated presentations and expert panel discussions on key international growth topics

Networking with fellow innovators, government partners, industry specialists and investors

Tools, resources and coaching from the Judges to help scaling businesses grow, commercialise and succeed

Specific information on how to complete the Business Plan required for Semi-Finalists in the next phase of the competition

Catered food and drinks: morning tea, lunch and afternoon tea

Cocktail Networking Reception after Day 1

Topics will range from the R&D Tax Incentive, raising capital, perfecting your pitch, entering new markets and more. There will also be time for you to ask questions and interact with panel discussions.

Unlocking the Power of Open Banking: A Safe and Secure Financial Future for Australians

Join WeMoney for an insightful event hosted by FinTech Australia at Riff (Spacecubed) in Perth, focusing on the transformative potential of the Consumer Data Right (CDR) and Open Banking in Australia. This event is designed to help understand how Open Banking can create a safe and secure financial future for all Australians.

Event Details

Date: 17th of June 2025

Time: 5:00pm AWST

Location: Riff (Spacecubed) 45 St Georges Perth WA

About the Event

The Consumer Data Right “Open Banking” is set to unlock the power of financial data, creating new opportunities and improving financial services for Australians. This event will delve into the current state of progress with the CDR, alongwith exciting exclusive insights into the future.

FinTech Australia is the largest member based organisations.

Who Should Attend

This event is perfect for:

Financial Industry Professionals: Banking and Finance industry leaders, and analysts looking to stay ahead in the evolving financial landscape.

Fintech Enthusiasts: Entrepreneurs, developers, and tech enthusiasts eager to explore the latest trends and innovations in financial technology and are looking to build the future of financial services.

Policy Makers and Regulators: Individuals involved in shaping the future of Australia's financial regulations and consumer data rights.

Anybody who wants to learn more about the Consumer Data Right, Open Finance and Open Banking.

Special Guest Speakers

We are honoured to have a distinguished panel of speakers, including:

Senator Dean Smith (Shadow Assistant Minister for Competition, Charities and Treasury): Representing Western Australia, Senator Smith As a key advocate for consumer rights and competition, he will provide valuable insights into the views policy and the promise of an innovative financial future leveraging the Consumer Data Right

Rehan D'Almeida: CEO of FinTech Australia, Rehan brings a wealth of knowledge about the fintech landscape and will discuss the broader implications of CDR on the industry.

Ruth Hatherley: CEO & Founder of Moneycatcha, Ruth will share her CDR journey on how Moneycatcha approaches product and pricing offers via the Regchain platform and her experience to date.

Dan Jovevski: Founder & CEO of WeMoney, Dan will share practical examples of how Open Banking can empower consumers and improve financial well-being through the unique journey at WeMoney.

In addition to our featured speakers, we are excited to announce that more industry experts and thought leaders will be joining us. Stay tuned for updates on our additional guest speakers who will bring diverse perspectives and expertise to the discussion.

Why Attend?

Gain Insights: Learn from leading experts about the opportunities and challenges of Open Banking.

Network: Connect with professionals, innovators, and enthusiasts in the fintech and financial services sectors.

Stay Informed: Keep up-to-date with the latest developments in financial technology and regulation.

Don’t miss this chance to stay ahead in the ever-evolving world of tech and finance. Unlock the potential of Open Banking and discover how it can create a safer and more secure financial future for all Australians.

Spaces are limited, book your FREE spot now.

TreviPay Fintech Seminar: Payments at the Crossroads - London Event

2024 is shaping up to be the year of B2B in fintech and innovation is happening at the crossroads of consumer and business models. Join us to set your enterprise up for success.

Join TreviPay and industry insiders at our exclusive B2B payments forum. Sit down with payments, eCommerce and banking leaders for an energizing conversation around industry trends, how to drive growth by offering more payment options and why AI and automation are game changers.

Navigating the Future of Insurance — Monoova

Join us for an engaging exploration of the evolving landscape of the insurance sector, looking at the changes, challenges, and implications for your business.

Hear from a panel of industry experts on how to prepare for these shifts and capitalise on new opportunities in digital transformation and emerging payment trends including payment optimisation.

Panel guests include:

Dhun Karai, Non Executive Director, Partner Financial Advisory, Grant Thornton Australia

Anna Cranney, Partnerships Manager, Insurtech Australia

Geoffrey Dirago. Vice President, APAC, Guidewire Software

Johan Nelis, Snr Director, International Solution Consulting, Duck Creek Technologies

Edward Wiley, Head of Growth, Monoova.

Schedule

12:00PM Registration, buffet lunch available

12:30PM Panel discussion

1:30PM Networking

Unlocking more choice for consumers through CDR data.

Regchain is hosting an in-person event in Sydney on Tuesday, 28th May, commencing at 5pm.

The event will include drinks and nibbles, plus time for networking.

It will feature a panel discussion hosted by Annie Kane, the esteemed Mortgages Editor of The Adviser Magazine, on the topic of: "Unlocking more choice for consumers through CDR data."

Annie will be interviewing an expert panel, comprising:

Ruth Hatherley from Regchain

Mike Page from MogoPlus

Lance Goodman from Compare Club, and

Sam McCready from AFG.

There will be lots to talk about, and there will be a focus on home loans, which is highly relevant with Australia in the grips of a housing affordability crisis.

The event will be especially relevant for mortgage brokers, aggregators, bank and non-bank home lenders, consumer advocates, credit analytics providers, personalisation and behavioural finance experts, open banking providers, fintechs, technology providers, regulators ... and more!

Registration is free and open to all interested parties.

Webinar: Australian Commercial Risk Barometer | illion

New report finds insolvencies could double in 2024 Following the launch of our Consumer Credit Stress Barometer in 2023, we are now launching a Commercial Risk Barometer.

In this new report, illion data scientists analyse key commercial data points to predict likely economic outcomes in the future.

A significant finding in our latest report is that business failure risk has risen by more than 6% in the 15 months to March 2024. This follows a long period of stability up to the end of 2022, likely due to government and lender support of smaller businesses.

The overall rise in business failure risk means that close to twice as many businesses are now at risk of forced closure compared to this time last year, either through liquidation or involuntary deregistration.

Ultimately, insolvencies in 2024 may be up to double those seen in 2023.

Don’t miss this important webinar where illion data scientists and business experts discuss which sectors are most at risk, and where they are located.

Next-Gen Family Offices: Capitalising on Venture Opportunities

Join us for an intimate discussion about the next generation of family offices using Venture Capital in their portfolio construction to drive differentiated returns. Next-Gen Family Offices: Capitalising on Venture Opportunities is an invite-only event designed in collaboration with Euphemia, Larsen Ventures, and Co Ventures.

We'll also touch on:

How to think about different stages of investment risk and their impacts—pre-seed, seed, Series A, and growth.

How to find strategic venture alignment with your family office.

Emerging fund managers and the opportunities they present.

Your speakers:

🎤 Dominic Pym - Founder, Euphemia: Investing in Tomorrow's Startup Scene

🎤 Maxine Minter - General Partner, Co Ventures: Australia's First Dedicated Pre-Seed Solo GP Fund

🎤 Andrew Larsen - Investment Director, Larsen Ventures: Family-backed investment fund

Your hosts:

As a family office, Euphemia also invests in venture capital and private equity funds, traditional asset classes, and the Euphemia Foundation (to support people in need). They have more than $15m invested in more than 20 venture funds globally, including at least a dozen Australian funds.

Co Ventures invests in Australian-founded pre-seed companies that will grow to the US, where Co Ventures can help accelerate them into the US ecosystem. Join this event to learn more about Co Ventures before its final fundraising close in June 2024.

Aside from his work at Larsen Ventures, Andrew is also a partner at Folklore Ventures and a board member at several growth-stage startups.

Postcard from Miami: The Nacha Smarter Faster Payments Conference

Each year over three days, the annual Nacha Smarter Faster Payments Conference is the centre of the real-time payments universe.

At this year’s conference in Miami, Zepto’s Chris Jewell and Elizabeth McQuerry [Partner, Glenbrook Partners] are co-presenting the conference’s 'Enabling Commerce in Faster Payments' session which looks at the importance of building robust instant payment ecosystems, and highlights the different pay-by-bank solutions from around the world including Australia's world class PayTo.

But there’s so much more to this global gathering of the payments cognoscenti than that.

Among the keynotes and celebration of Nacha’s 50th anniversary, the conference streams will meander through a mountain of topics including:

Disruptive Ideas & Technologies

Smarter Payments Experiences

Faster Payments Experiences

Compliance & Regulation

Cybersecurity & Risk

Join the Postcard from Miami: The Nacha Smarter Faster Payments Conference virtual fireside chat on the 15th of May.

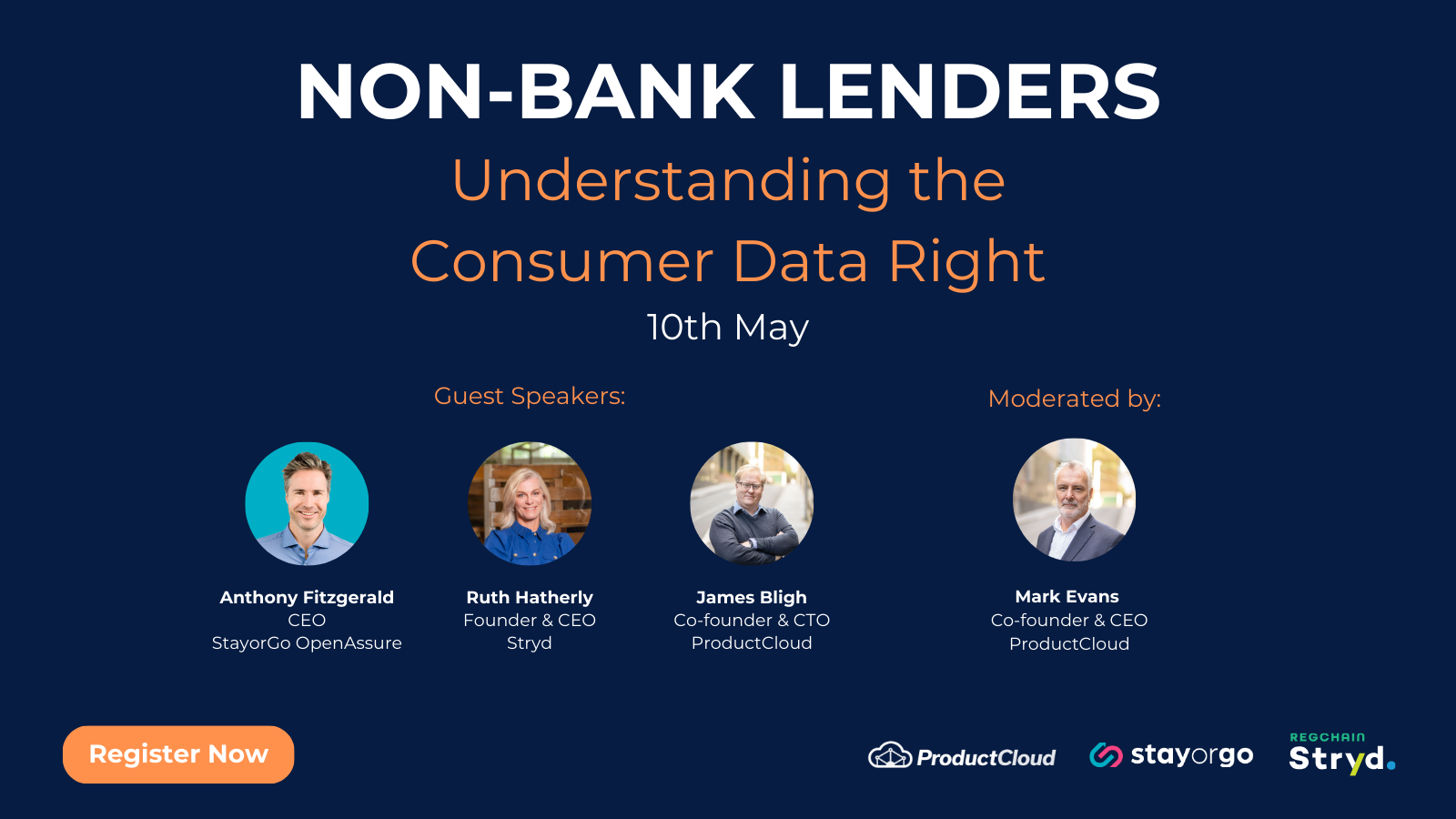

Webinar: Non-Bank Lenders - Understanding the Consumer Data Right

As the Consumer Data Right expands its reach, incorporating the non-bank lender sector, it's crucial to explore the challenges, risks and strategic opportunities it will present to you. Join us as we hear from 3 guest speakers with deep experience in the CDR rollout to banks as they explore the challenges and opportunities, whether directly impacting your business or not. This will be an interactive and open session with an opportunity for a Q&A .

Guest Speakers:

Anthony Fitzgerald, CEO, OpenAssure

Ruth Hatherly, CEO and Founder, Stryd

James Bligh, CTO and Cofounder, ProductCloud

Moderated by: Mark Evans, CEO and Cofounder, ProductCloud

Securing and Preventing Fraud in Digital Payment Systems - CRC-P Industry Workshop

RMIT’s University's Centre for Cyber Security Research and Innovation, in proud partnership with Novatti and Deakin University, is delighted to invite you to a free afternoon workshop in Melbourne.

The workshop will feature interesting talks from RMIT, LaTrobe University, and Novatti. Join us to get insights into the current challenges, legal implications, and emerging trends in fraud prevention and security in payments.

Market Insights & Tax Debt Strategies for SMEs | Free Webinar

ATO’s debt book has increased 85% in 2023 meaning there are 100s and 1000s of businesses facing challenges in paying off their tax debt.

Join Swoop for an insightful webinar that delves into the dynamic intersection of market trends and tax debt challenges faced by businesses in 2024. This webinar aims to empower business owners and finance professionals with strategic insights to navigate the ever-evolving financial landscape and the mounting tax debt on businesses.

Hosted by Michael Moon, Director – Tax Assure and Cynthia De Vera, Head of Australia - Swoop Funding,

When: Wednesday, 7th February 2024 – 12:00pm (AEST)

Webinar Highlights

Market Trends Impacting Businesses:

Tax Debt Challenges and Debt Compliance:

Risk Mitigation Strategies:

Tax Debt Recovery Practices - ATO Focus and Navigation Strategies

Case Studies and Best Practices:

Scaling Success Webinar: From the UK to Australia - TechVisa

📣 Calling all UK Founders!

Are you thinking of scaling your business to the Australian market? 🚀

We couldn't be more excited to partner with Think & Grow to bring you this FREE "Scaling Success Webinar: From the UK to Australia"

Don't miss out on the fun, learnings and expertise—register now!

🗓️ Wed 7th February, 8:30am GMT

REGISTER HERE

Get ready to:

- Unlock the essential pillars for your expansion strategy.

- Navigate visa options with expert guidance.

- Gain tactics to get HQ on board seamlessly.

- Learn how to make a lasting impact in the Aussie market.

Stripe AUNZ Startup Growth Summit 2024

Industry expert speakers will share strategies for success in 2024.

It's a one-day conference for forward thinking leaders eager to shape the future and elevate their game in the new year.

Experienced founders and C-suite executives will share market insights, live demos, and their experiences on:

Adopting generative AI to redefine the future of your businesses

Alternative strategies to boost ROI

Best practices for building teams globally and scaling internationally

Key trends and opportunities shaping 2024 and beyond

Basiq Summit

The Basiq Summit 🌟

This November, the Basiq Summit beckons! Dive into meaningful discussions about the evolving landscape of CDR and explore the latest advancements in Data, Insights, and Payments on the Basiq platform.

But that's not all. At the chic Ivy Sunroom, we're blending business with pleasure. Expect delightful entertainment and enriching conversations, all sprinkled with a touch of Basiq charm ✨

Whether you're part of a financial institution, a fintech aficionado, a rising startup, an insightful investor, or simply keen on the future of financial services, this summit promises value for all. You'll leave invigorated, informed, and inspired about what's next in the finance world.

Mark your calendars 🗓 and secure your spot now to join us for what promises to be the financial services event of the year.

Spaces are limited!

See you there! 👋

Derisking the CDR for Non Bank Lenders

Non-bank lenders will join the Consumer Data Right (CDR) regime along with banks and energy companies as soon as November 2024.

Non-Bank Lenders must carefully consider how the CDR product and customer data milestones are planned and executed.

Join ProductCloud’s webinar “Derisking CDR for Non-Bank Lenders” to learn more.

ProductCloud Co-founders James Bligh and Mark Evans will provide an overview of the proposed rules, how to manage the risks and challenges and share lessons learnt from previous sector rollouts.