Member Spotlight: Frollo, paving the way for fintech in CDR

The advent of Covid-19 has accelerated the adoption of technologies such as videoconferencing at the workplace and in court, and the signing of documents electronically, both at a federal and state level. One other area of fintech innovation that will likely benefit greatly from this rapid adoption is the Consumer Data Right.

What is the Consumer Data Right?

The Consumer Data Right (“CDR”) is a data portability right that allows consumers to have greater control over who gains access to their financial data, and what it is used for. The regime developed from the 2017 Open Banking Review led by Scott Farrell and was brought into law on 12 August 2019.

After several delays, the regime is due for a July start and is currently undergoing further public consultation by the Inquiry into Future Directions for the Consumer Data Right. Spearheaded by Scott Farrell, the inquiry will examine how the CDR can be “enhanced and leveraged to boost innovation and competition, and support the development of a safe and efficient digital economy”. The review, among other things, will specifically address whether the CDR should be expanded to cover switching, write access, interoperability with existing systems and frameworks and will examine future applications of CDR beyond what is currently planned.

The First Fintech Accreditation

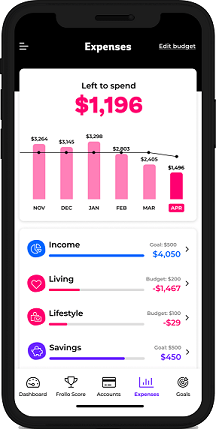

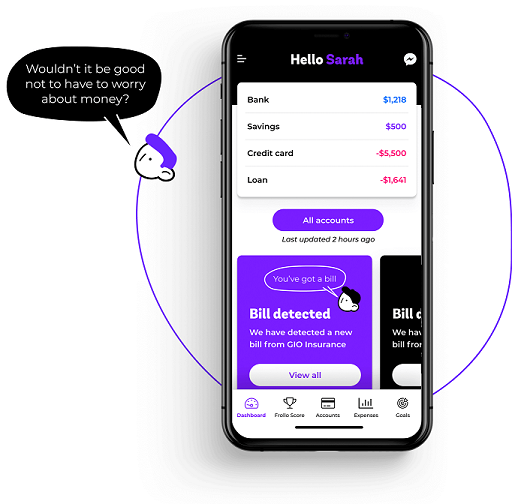

As the regime’s start date looms, entities hoping to participate in the regime are beginning to receive accreditation. Frollo, an Australian personal and budget management platform provider, is the first fintech in Australia to receive accreditation. “To be the first FinTech to become an Accredited Data Recipient is a big milestone for us. We already help users get a fuller picture of their finances”, says Frollo CEO, Gareth Gumbley. “Our users will immediately notice how much faster they will be able to take control of their money through open banking. But more importantly, we’ll be able to show them more of the simple steps towards paying down debt faster and growing their savings.”

The CDR will give fintechs access to data that has traditionally only been accessible to larger financial institutions, will increase competition in the market, and promote innovation in the fintech sector. “Testing the CDR ecosystem has given us some unique insights that we simply would not have had and our product roadmap is benefiting from that,” stated Mr Gumbley.

According to Frollo’s CIO, Tony Thrassis, becoming the first non-bank to achieve CDR accreditation was no mean feat. “Implementing the technology and compliance to make this happen so quickly required the full talent of our team and their combined expertise. Soon we’ll be leveraging the benefits of behavioural economics, artificial intelligence, and better data to help even more Australians feel good about money. But Open Banking is not something you do once and forget. It’s the start of a new consumer-driven digital experience that requires complete immersion and constant innovation.”

In acknowledging the ACCC for the opportunity to participate in the Open Banking trial, Mr Gumbley also said, “I hope our efforts and contribution to this new era of banking in Australia brings about more innovation from FinTechs and other financials to benefit both consumers and businesses.”

On the impact and opportunities presented by Covid-19, Mr Gumbley said, “With the impact of Covid-19 hitting millions of Australians hard financially, Frollo’s quest to help people feel good about money is more important now than ever. That’s just one of the reasons why we’re excited to be one of the first to launch when Open Banking goes live in July. Our users will immediately notice how much faster they will be able to take control of their money through Open Banking. But more importantly, we’ll be able to show them more of how to take those few simple steps towards paying down debt faster and build their savings.”

Despite its challenges, Covid-19 has presented unique opportunities for the fintech ecosystem with the right market fit. We are here to support the fintech ecosystem and its participants through these times and we encourage you to reach out if you need a hand.