FY22 Micro-Investing Report Press Release

Cache Micro-Investing Report 2022

Annual review of micro-investing industry trends and developments in Australia

Sydney, NSW: Cache has produced its 2nd Annual Micro-investing Report, detailing key industry insights, distinct product features & functions and new entrants in the market."The Australian micro-investing sector overcome volatile economic conditions to post the strongest year of accountholder growth on record.""Micro-investing has an important role in democratising access to investments and is changing the way Australians manage money for the better.""Micro-investing products bring down the barriers to invest and help many more people start practicing healthy investing behaviours for the first time - behaviours that may compound to benefit them throughout the course of their lives."- Caleb Gibbins, Founder & CEO, Cache.Key points:

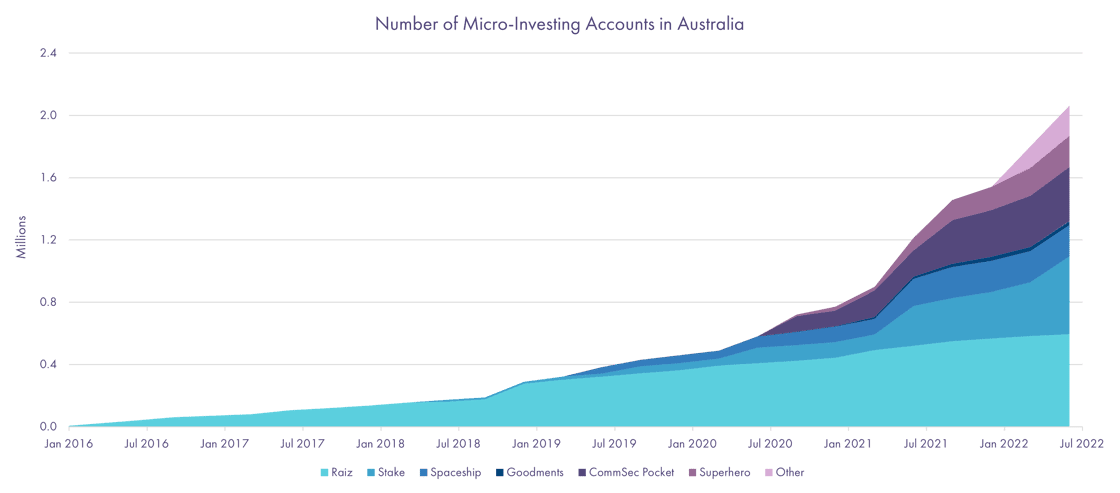

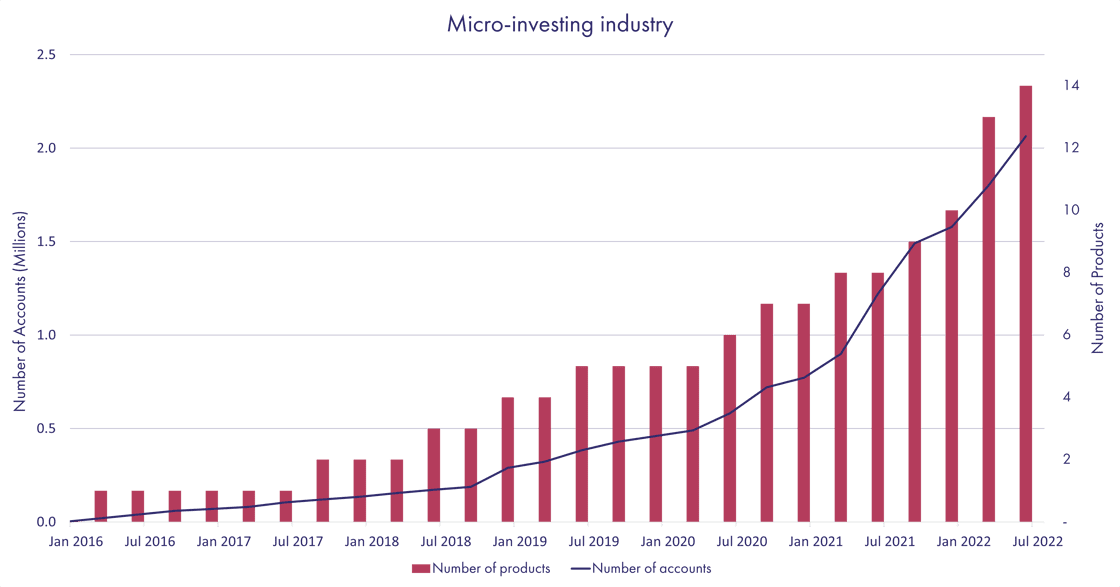

- Micro-investing account numbers grew by 840,000 to 2.05M at June 2022

2. There has been a 75% increase in the number of market participants. There has been 6 new micro-investing products launched in FY22, increasing the total in this year’s report to 14.

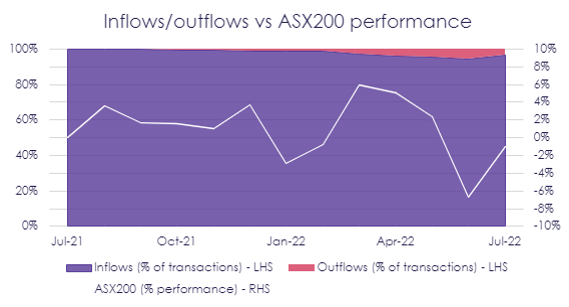

3. Despite market volatility 95% of transaction volume within micro-investing products were inflows with only 5% outflows

The full report is available for download here

The full report is available for download here

About Cache: Cache is Australia’s #1 investing-as-a-service provider, offering white-label investment products so that companies of all sizes – from Fintechs to Banks – can help more people invest. Cache’s nimble, compliant and scalable digital solutions can be provided in as little as 90 days, and at a significantly lower cost then traditional options.