Average value of invoices down 28% YoY as demand and cost pressures squeeze businesses

The July 2023 CreditorWatch Business Risk Index (BRI) has revealed the average value of business invoices has fallen by almost a third over the past 12 months, with a drop of 28% year-on-year.

This massive drop in the value of invoices means Australian businesses are ordering less each month leading to a fall in revenues throughout the supply chain.

CreditorWatch’s other key business indicators, trade payment defaults, credit enquiries, external administrations and court actions have also deteriorated.

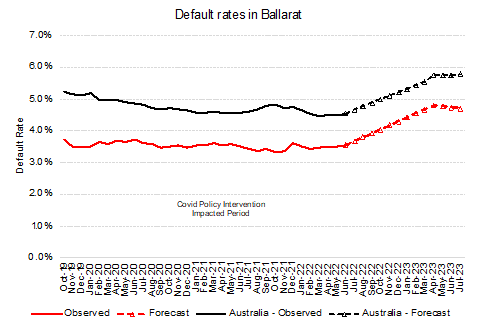

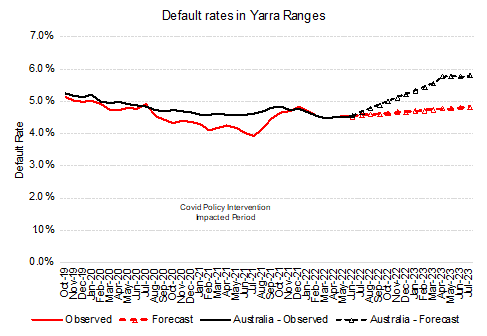

The Business Risk Index July results have also revealed Ballarat is now ranked as the region in Australia least likely to see businesses fail, with a second Victorian region, Yarra Ranges, also included in the top five.

Key Business Risk Index insights for July:

· Average value of invoices for Australian businesses has dropped 28% over the past 12 months.

· B2B trade payment defaults continue to trend upward, with an 86% year-on-year increase.

· Credit enquiries dropped from June to July but are still up 66% year-on-year, reflecting the tightening of due diligence that businesses and lenders are performing on debtors.

· External administrations have increased 10% year-on-year, with most industries experiencing an increase in this measure.

· Court actions were flat from June to July but are up 17% year-on-year.

· CreditorWatch’s national default rate prediction for the next 12 months is for an increase from the current rate of 4.67% to 5.76%.

· Businesses in the food and beverage services sector remains the most at risk of payment defaults (6.9%) by a considerable margin. Transport, Postal and Warehousing is the next riskiest industry at 4.4%.

· The regional Victoria regions of Ballarat and Yarra Ranges are in the top five regions in Australia for lowest risk of business failures.

· Ballarat in Victoria is the region with the lowest risk of business failure (across regions with more than 5,000 businesses), followed by Unley and Norwood-Payneham-St Peters in South Australia.

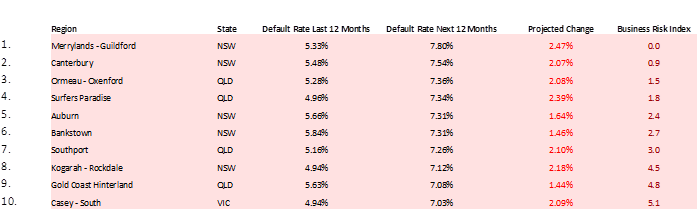

· The regions with the highest insolvency risk continue to cluster around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) recording a forecast default rate of 7.80% for this time next year.

CreditorWatch CEO, Patrick Coghlan, says the size of the drop in the average value of invoices is a major concern for the Australian economy.

“Over the past year, the decline in the value of invoices has been consistent and severe, he says. “This deterioration is reflected in our other key business indicators: payment defaults, external administrations, credit enquiries and court actions.

“It will be the industries most exposed to consumer discretionary spending such as hospitality and retail that will experience the toughest conditions across the second half of this year.

CreditorWatch Chief Economist, Anneke Thompson, says our BRI data supports the assessment of the RBA that economic growth is going to slow considerably over the second half of calendar year 2023. The RBA forecasts GDP to slow to 0.9% over the year to December 2023, down from 1.6% over the year to June 2023. Household consumption has already slowed considerably, with the slowdown expected to worsen as more households come off fixed rate home loans. Household consumption is expected to have only grown by 1.6% to June 2023, and is forecast growth for the year to December is 1.3%.

Average value of invoices

The average value of invoices held by Australian businesses has dropped 28% year-on-year as consumer demand and business confidence fall away while costs rise. We expect this measure to deteriorate further as challenging business conditions and increasing expectations of a recession in Australia further erode business and consumer confidence.

Data source: CreditorWatch trade receivables data (accounting software integration)

B2B trade payment defaults

Trade payment defaults continue to paint a worrying picture of cash flow constraints among Australian small businesses. The volume of trade payment defaults we have recorded over the past three months have been some of the highest on record, and there has been a noticeable increase in the trend since June 2022.

CreditorWatch business failure rate prediction

CreditorWatch’s business failure rate prediction over the next year is, worryingly, increasing from current levels. By July 2024, we expect 5.79 per cent of Australian businesses to have failed over the past year, up from 4.67 per cent today. Unfortunately, the slowdown in economic activity is going to cause casualties, and we expect that the food and beverage sector will bear the greatest cost due to both the slowdown in discretionary spending and continued high input costs.

Data Source: CreditorWatch Business Risk Index – Business default defined as entering external administration or strike-off

Best and worst regions and capital cities (5,000+ businesses)

Areas with an older median age present the lowest risk of business insolvency, as these businesses are likely to have lower debt levels and more established income streams. Areas with the highest risk of insolvency not only tend to have younger populations, but also business profiles that are more strongly weighted to construction, tourism and retail trade.

The variance between the areas with lowest risk and highest risk of business failure is also expected to widen. Currently, the difference between these two is 234 basis points (bps), however, by July 2024, this spread is forecast to widen to 308 bps. There are major differences in how the economic downturn is expected to impact locations around Australia.

For example, Yarra Ranges (Vic) is only expected to see a 25 bps increase in its business failure rate. In Merrylands-Guildford (NSW) and Surfers Paradise, the increases in business failure rates are expected to grow by 247 and 239 bps respectively.

July 2023 labour force data indicates that weakening in the business sector is already starting to occur in NSW and Queensland. Both states recorded sizeable increases to their seasonally adjusted unemployment rates, at 0.4% and 0.8% respectively. While unemployment in NSW is still a very low 3.3%, unemployment in Queensland has hit 4.5%, well above the Australian rate of 3.7%. The construction sector in Queensland, in particular, has been under considerably strain in recent months.

Sources: CreditorWatch Business Risk Index and ABS

Worst regions (5,000+ businesses)

Sources: CreditorWatch Business Risk Index and ABS

Why are certain areas in regional Vitoria performing so well?

Businesses in Ballarat and Yarra Ranges in Victoria are statistically some of the least likely to fail, and our forecasts indicate that this is likely to remain the case. While Yarra Ranges is technically a metro Melbourne location, it sits on the north-east periphery of the city, and includes the decidedly rural Yarra Valley winery region, as well as the popular tourist town of Healesville.

Ballarat is also a popular tourist region for Melburnians in particular. Both areas have very established businesses and remain affordable places to visit for local and international tourists. Notably both regions have access to very good schools, giving families long term reasons to locate in the area, and producing a relatively highly educated workforce.

Source: CreditorWatch Business Risk Index July 2023

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

1. Food and Beverage Services: 6.95%

2. Transport, Postal and Warehousing: 4.43%

3. Arts and Recreation Services: 4.42%

The industries with the lowest probability of default over the next 12 months are:

1. Health Care and Social Assistance: 3.18%

2. Wholesale Trade: 3.33%

3. Manufacturing: 3.41%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

According to the ABS’s retail trade volume data, Australians purchased less in quantity terms at cafes and restaurants over the June quarter, compared to the preceding quarter. This is the first volume decrease recorded since the September 2021 quarter, which was a lockdown induced drop, While the drop in purchasing volumes was only 0.1%, it does point to a change in spending behaviour of Australians and indicates that demand side issues are now going to compound the supply side pressures that café and restaurant operators are already facing.

Industry insolvency rates

Food and Beverage, as well as Construction, continue to feature in the top three industries with the highest insolvency rates. Surprisingly, insolvency rates in the mining industry have increased, although this sector does shift around as it is highly susceptible to commodity price volatility, environmental regulation and resource depletion.

Source: CreditorWatch Business Risk Index April 2023

Outlook

The operating environment for Australian businesses will continue to have an elevated level of risk as we settle into a period of higher interest rates, probably for the next year. Australian consumers’ cash reserves are falling away dramatically, and this slowdown in spending eventually works its way through the wider economy. Population growth continues to have a positive impact on the Australian economy, driving demand for education, health and professional services. However, even with strong population growth, retail trade volumes are in retreat, highlighting just how much spending by Australians has decreased.

This article was provided by CreditorWatch